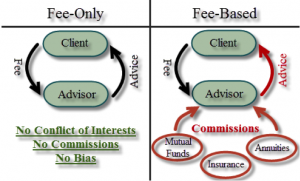

Consumers are frequently confused between the terms fee-only and fee-based assuming they mean the same thing. However, these terms refer to how your advisor is compensated and they have vastly different meanings. Whether your advisor is “fee-only” or “fee-based” will have a huge impact on the type of advice from a financial advisor, you are provided and the types of investment products which are recommended to you.

Fee-Only advisor means the only source of compensation your advisor receives is from fees paid directly to the advisor from clients. This could be in the form of an hourly fee, a retainer fee or a percentage of the assets under management. Regardless of the type of fee, the point is that the client pays only a fee and no other type of compensation is charged. No commissions are received. No financial products are sold. No commissioned annuities are recommended. Advice is totally independent of the investment process.

Fee-Based is a term the brokerage community developed to counteract the success of the Fee-Only classification. The terms certainly sound similar and consumers are confused, so their strategy seems to be working. Where fee-based can be misleading is that not only does an advisor receive fees under a fee-based compensation system, but they can also accept commissions from financial products recommended, or annuities and insurance sold. This system creates the potential for a huge conflict of interest. If an advisor has the opportunity to recommend a particular financial product that pays him/her a commission versus a financial product that does not pay a commission, which one do you think they will recommend?

Finally, you want to make sure that your advisor is an independent fiduciary advisor. Independent Registered Investment Advisors (RIAs) are professional independent advisory firms that provide personalized financial advice to their clients, many of whom have complex financial needs. Because these advisors are independent, they are not tied to any particular investment or insurance products. As fiduciaries, they are held to the highest standard of care – and are required to act in the best interests of their clients at all times.

Since our beginning, Davis Capital Management has acted in the best interest of our clients and we wouldn’t have it any other way.